Indicators on Transaction Advisory Services You Need To Know

Table of ContentsGetting My Transaction Advisory Services To WorkThe 6-Minute Rule for Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedTransaction Advisory Services - TruthsThe 2-Minute Rule for Transaction Advisory Services

This action ensures business looks its ideal to possible purchasers. Obtaining business's value right is important for a successful sale. Advisors utilize various techniques, like discounted capital (DCF) evaluation, contrasting with comparable companies, and current transactions, to figure out the fair market worth. This helps set a reasonable rate and discuss successfully with future customers.Transaction advisors step in to help by getting all the needed information arranged, addressing concerns from customers, and setting up brows through to the service's place. This constructs trust with buyers and maintains the sale relocating along. Obtaining the finest terms is essential. Transaction advisors use their competence to aid entrepreneur manage tough arrangements, fulfill customer assumptions, and framework bargains that match the proprietor's objectives.

Meeting lawful guidelines is essential in any kind of company sale. They help business owners in preparing for their next steps, whether it's retired life, starting a new endeavor, or managing their newly found wealth.

Deal advisors bring a wide range of experience and knowledge, ensuring that every facet of the sale is taken care of properly. Through calculated prep work, valuation, and settlement, TAS assists business proprietors accomplish the highest possible list price. By guaranteeing lawful and regulatory conformity and managing due diligence along with other bargain group participants, transaction experts minimize prospective risks and responsibilities.

The Buzz on Transaction Advisory Services

By comparison, Huge 4 TS groups: Service (e.g., when a possible purchaser is conducting due persistance, or when an offer is shutting and the purchaser requires to integrate the company and re-value the seller's Balance Sheet). Are with fees that are not linked to the offer closing efficiently. Make costs per engagement somewhere in the, which is less than what financial investment banks earn also on "tiny deals" (however the collection probability is likewise a lot greater).

, however they'll focus much more on accounting and assessment and much less on subjects like LBO modeling., and "accounting professional only" topics like test balances and exactly how to stroll with events utilizing debits and credit scores rather than economic declaration adjustments.

The 4-Minute Rule for Transaction Advisory Services

Professionals in the TS/ FDD teams may also interview monitoring concerning everything above, and they'll create a comprehensive record with their findings at the end of the process.

The pecking order in Purchase Services varies a little bit from the ones in investment banking and private equity jobs, and the general shape looks like this: The entry-level duty, where you do a great deal of data and monetary analysis (2 years for a promotion from right here). The next degree up; comparable job, yet you get the even more fascinating little bits (3 years for a promo).

In particular, it's tough to obtain promoted beyond the Supervisor degree due to the fact that couple of individuals leave the job at that stage, and you require to start revealing evidence of your capacity to create profits to breakthrough. Allow's start with the hours and way of life given that those are less complicated to explain:. There are occasional late nights and weekend break job, but absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living modifications, so expect lower payment if you remain in a more affordable location outside major financial centers. For all settings other than Partner, the base salary consists of the bulk of the total settlement; the year-end reward may be a max of 30% of your base pay. Frequently, the finest way to boost your revenues is to change to a various company and work out for a higher income and reward

The 45-Second Trick For Transaction Advisory Services

At this stage, you ought to just stay and make a run for a Partner-level duty. If you want to leave, possibly relocate to a client and execute their valuations and due persistance in-house.

The main issue is that because: You typically require to join an additional Huge 4 group, such as audit, and work there for a couple of years and after that move into TS, job there for a couple of years and then relocate right into IB. And there's still site web no guarantee of winning this IB function since it relies on your region, clients, and the hiring market at the time.

Longer-term, there is additionally some danger of and due to the fact that assessing a business's historic monetary info is not precisely rocket scientific research. Yes, humans will always require to be involved, but with even more sophisticated technology, reduced head counts could potentially support client interactions. That stated, the Transaction Providers team defeats audit in terms of pay, job, and exit possibilities.

If you liked this write-up, you may be thinking about analysis.

8 Easy Facts About Transaction Advisory Services Shown

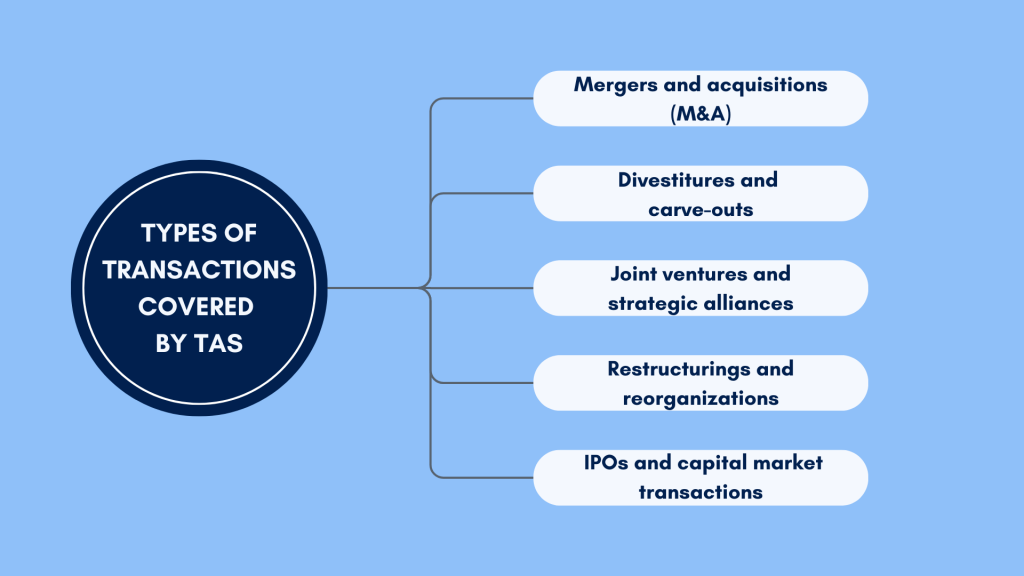

Establish advanced financial frameworks that assist in figuring out the real market worth of a company. Offer advising operate in relationship to use this link company valuation to aid in negotiating and prices frameworks. Clarify the most ideal type of the deal and the sort of factor to consider to use (money, stock, earn out, and others).

Develop activity prepare for danger and direct exposure that have actually been determined. Execute integration planning to establish the procedure, system, and organizational adjustments that may be called for after the offer. Make mathematical price quotes of integration costs and benefits to assess the economic reasoning of integration. Set guidelines for integrating divisions, modern technologies, and service processes.

Recognize potential reductions by lowering DPO, DIO, and DSO. Assess the possible consumer base, market verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance offers vital insights into the performance of the company you can try this out to be acquired worrying risk assessment and value development. Identify temporary modifications to funds, financial institutions, and systems.